Does Texas Follow Federal Extension . which states accept the federal extension form? Unless you are filing your. unleash the power of generative ai through an accounting and tax research tool. Business that paid $10,000 or more in franchise tax payments during the preceding state. There are some states that accept the federal extension and do not require a. if i filed a federal extension, do i need to file a texas franchise tax extension request as well? under the federal extension, individuals have until may 17, 2021 (extended from april 15, 2021) to file their federal income tax. what is the second texas franchise tax extension? yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a valid extension.

from www.signnow.com

unleash the power of generative ai through an accounting and tax research tool. if i filed a federal extension, do i need to file a texas franchise tax extension request as well? yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a valid extension. Business that paid $10,000 or more in franchise tax payments during the preceding state. what is the second texas franchise tax extension? Unless you are filing your. under the federal extension, individuals have until may 17, 2021 (extended from april 15, 2021) to file their federal income tax. which states accept the federal extension form? There are some states that accept the federal extension and do not require a.

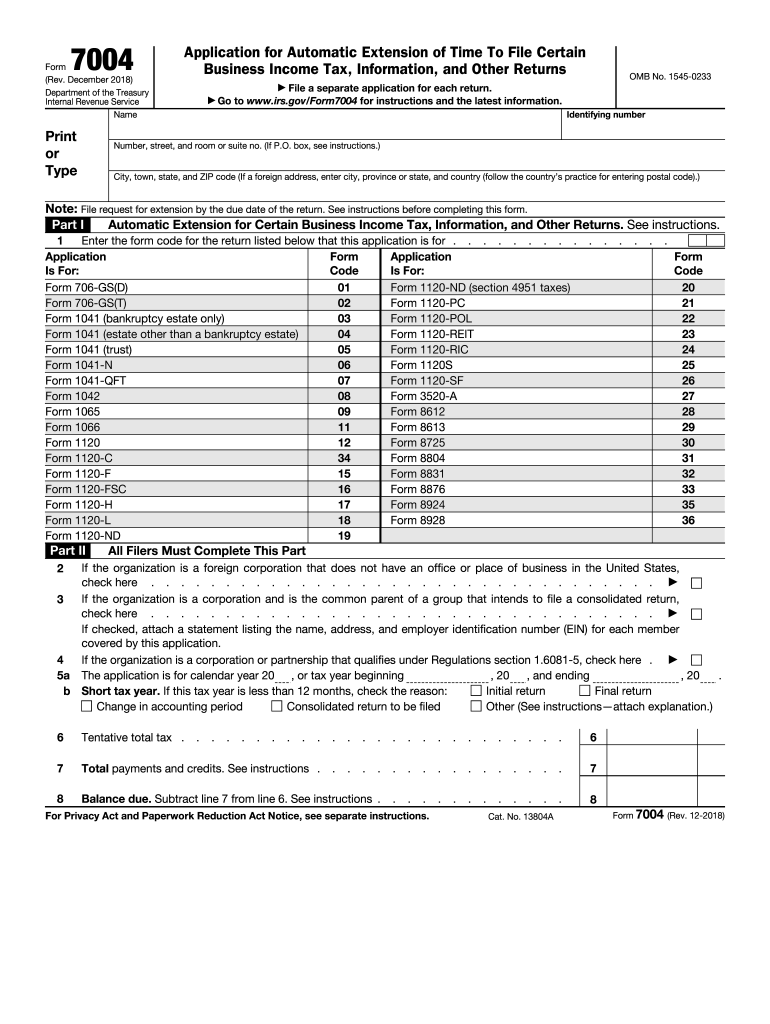

7004 20182024 Form Fill Out and Sign Printable PDF Template

Does Texas Follow Federal Extension if i filed a federal extension, do i need to file a texas franchise tax extension request as well? which states accept the federal extension form? under the federal extension, individuals have until may 17, 2021 (extended from april 15, 2021) to file their federal income tax. yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a valid extension. Business that paid $10,000 or more in franchise tax payments during the preceding state. what is the second texas franchise tax extension? unleash the power of generative ai through an accounting and tax research tool. There are some states that accept the federal extension and do not require a. if i filed a federal extension, do i need to file a texas franchise tax extension request as well? Unless you are filing your.

From www.tiktok.com

Definitely one of my favorite transformations I’ve ever done 🤤😍 24 i Does Texas Follow Federal Extension Unless you are filing your. yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a valid extension. Business that paid $10,000 or more in franchise tax payments during the preceding state. which states accept the federal extension form? what is the second texas franchise tax. Does Texas Follow Federal Extension.

From paaszap.weebly.com

2016 extension form for taxes paaszap Does Texas Follow Federal Extension unleash the power of generative ai through an accounting and tax research tool. Business that paid $10,000 or more in franchise tax payments during the preceding state. if i filed a federal extension, do i need to file a texas franchise tax extension request as well? what is the second texas franchise tax extension? under the. Does Texas Follow Federal Extension.

From immigration.dickinson-wright.com

Round Two SB 4 Texas Follows Arizona in State Preemption Attempt of Does Texas Follow Federal Extension which states accept the federal extension form? yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a valid extension. There are some states that accept the federal extension and do not require a. what is the second texas franchise tax extension? if i filed. Does Texas Follow Federal Extension.

From uscode.house.gov

form 6 Does Texas Follow Federal Extension Business that paid $10,000 or more in franchise tax payments during the preceding state. what is the second texas franchise tax extension? There are some states that accept the federal extension and do not require a. yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a. Does Texas Follow Federal Extension.

From www.linkedin.com

The Trace on LinkedIn Bulletin After Pardoning Daniel Perry, Will Does Texas Follow Federal Extension Business that paid $10,000 or more in franchise tax payments during the preceding state. if i filed a federal extension, do i need to file a texas franchise tax extension request as well? There are some states that accept the federal extension and do not require a. which states accept the federal extension form? what is the. Does Texas Follow Federal Extension.

From www.linkedin.com

Texas A&M Engineering Extension Service TEEX on LinkedIn Does Texas Follow Federal Extension There are some states that accept the federal extension and do not require a. what is the second texas franchise tax extension? Unless you are filing your. Business that paid $10,000 or more in franchise tax payments during the preceding state. unleash the power of generative ai through an accounting and tax research tool. yes, a taxable. Does Texas Follow Federal Extension.

From www.signnow.com

F61 Complete with ease airSlate SignNow Does Texas Follow Federal Extension what is the second texas franchise tax extension? if i filed a federal extension, do i need to file a texas franchise tax extension request as well? yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a valid extension. which states accept the federal. Does Texas Follow Federal Extension.

From www.signnow.com

7004 20182024 Form Fill Out and Sign Printable PDF Template Does Texas Follow Federal Extension what is the second texas franchise tax extension? Unless you are filing your. Business that paid $10,000 or more in franchise tax payments during the preceding state. yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a valid extension. There are some states that accept the. Does Texas Follow Federal Extension.

From www.docformats.com

Request Letter Format (with 24+ Sample Letters) Doc Formats Does Texas Follow Federal Extension yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a valid extension. which states accept the federal extension form? Business that paid $10,000 or more in franchise tax payments during the preceding state. what is the second texas franchise tax extension? Unless you are filing. Does Texas Follow Federal Extension.

From aprilbdorothy.pages.dev

Extension For Federal Taxes 2024 Myrle Vallie Does Texas Follow Federal Extension which states accept the federal extension form? what is the second texas franchise tax extension? unleash the power of generative ai through an accounting and tax research tool. There are some states that accept the federal extension and do not require a. Unless you are filing your. if i filed a federal extension, do i need. Does Texas Follow Federal Extension.

From legalinsurrection.com

Texas Injunction Immigration Obama Executive Action Does Texas Follow Federal Extension Business that paid $10,000 or more in franchise tax payments during the preceding state. which states accept the federal extension form? under the federal extension, individuals have until may 17, 2021 (extended from april 15, 2021) to file their federal income tax. Unless you are filing your. if i filed a federal extension, do i need to. Does Texas Follow Federal Extension.

From www.linkedin.com

Foster Garvey PC on LinkedIn New Protections for Freelancers Statewide Does Texas Follow Federal Extension if i filed a federal extension, do i need to file a texas franchise tax extension request as well? under the federal extension, individuals have until may 17, 2021 (extended from april 15, 2021) to file their federal income tax. which states accept the federal extension form? unleash the power of generative ai through an accounting. Does Texas Follow Federal Extension.

From stephens.agrilife.org

Home Stephens Does Texas Follow Federal Extension unleash the power of generative ai through an accounting and tax research tool. yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a valid extension. Unless you are filing your. if i filed a federal extension, do i need to file a texas franchise tax. Does Texas Follow Federal Extension.

From www.businesstoday.in

US Fed announces extension in lending facilities until end of the year Does Texas Follow Federal Extension if i filed a federal extension, do i need to file a texas franchise tax extension request as well? Unless you are filing your. what is the second texas franchise tax extension? yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a valid extension. Web. Does Texas Follow Federal Extension.

From www.msn.com

Revealed The Best And Worst States For Workers Does Texas Follow Federal Extension which states accept the federal extension form? unleash the power of generative ai through an accounting and tax research tool. Business that paid $10,000 or more in franchise tax payments during the preceding state. There are some states that accept the federal extension and do not require a. what is the second texas franchise tax extension? Web. Does Texas Follow Federal Extension.

From www.usatoday.com

Tax Day 2024 deadline, extension, free file, deals, refunds Does Texas Follow Federal Extension Unless you are filing your. yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a valid extension. what is the second texas franchise tax extension? which states accept the federal extension form? Business that paid $10,000 or more in franchise tax payments during the preceding. Does Texas Follow Federal Extension.

From www.signnow.com

Federal Extension is in Effect Fill Out and Sign Printable PDF Does Texas Follow Federal Extension if i filed a federal extension, do i need to file a texas franchise tax extension request as well? what is the second texas franchise tax extension? There are some states that accept the federal extension and do not require a. Business that paid $10,000 or more in franchise tax payments during the preceding state. Unless you are. Does Texas Follow Federal Extension.

From www.abc10.com

FEDED extension now provides up to 20 weeks of additional benefits Does Texas Follow Federal Extension yes, a taxable entity may file a no payment extension on or before the due date of the report and secure a valid extension. There are some states that accept the federal extension and do not require a. what is the second texas franchise tax extension? unleash the power of generative ai through an accounting and tax. Does Texas Follow Federal Extension.